The company that did most of the tunneling work for the Dubai Metro and is now working on a new sewerage and wastewater system in Abu Dhabi says it has more than EUR 7 million worth of regional projects on hand being handled out of its UAE hub.

Milan-based Valente, the specialist in rail, tunneling and mining, is not, however, resting on its laurels. The company may be a household name in Europe, but it is a relative newcomer in the MENA region, where it is banking on several factors – such as strong central planning, a growing awareness of the value of mass transport, and burgeoning trade – to increase its footprint.

Valente became one of the first global companies in its field to set up a regional hub, at the Jebel Ali Free Zone in Dubai, two years ago. Currently, it says, about 10%-15% of the company’s activity is carried out of Valente JAFZA and represents less than 80% of overall revenue and operating profits.

Zawya interviewed Alberto Menoncello, President of Valente S.P.A., to get a feel for the company’s growth plans and its view on the region’s supporting strengths. Excerpts:

In which nations of the Middle East and North Africa is Valente executing contracts? Please give details of each contract, including the scope of work and the value.

We have done significant work on projects in the region for the last six years including almost all of the tunneling work for the Dubai Metro . Currently, we are working on the massive new sewer and wastewater system in Abu Dhabi and have active bids throughout the GCC. MENA region projects include Egypt, Tunisia, and Algeria. As you know, all projects are divided into phases. We have been involved on various phases of the projects listed; the figures given are for the current active phase.

Our JAFZA branch office coordinates most of our international activity so we will mention them as well. Naturally, new projects at the bid stage we cannot really discuss at this time but will be happy to announce if and when won.

How much of Valente’s global business comes out of MENA – what volume and percentage of revenues and operating profits come from here? How do you see this evolving over the next three to five years?

This is a very important question as it relates to our international development strategy which revolves around the establishment of our Jebel Ali Free Zone Branch in 2010. Currently about 10%-15% of our activity is carried out of Valente JAFZA and represents less than 80% of our overall revenue and operating profits – but we see that as growing rapidly.

This is our first international office and now covers all of our activity outside of Europe and a few selected countries. As you can see from the list of currently active projects, areas outside of the GCC and MENA region are also very important for us as they are coordinated in our JAFZA office.

How much of the MENA rail market does Valente own? How do you plan to increase this market share?

Not enough! We are newcomers to the region and although nearly a household name in Europe, barely known here yet. Estimating our market share is difficult due to the lack of overall published data but it is currently small. Regarding our plans to increase the market share – we have every hope that this will be the case. Valente has been operating continuously since 1919 and are considered specialists in our field especially for certain types of complex rail installations, tunneling and mining equipment. We know we have a long-term future here.

Where do you see maximum future growth in the regional rail industry coming from? What are the drivers of this growth?

When we discuss rail – it is important to point out that rail work is much wider and more diverse than the usual image of the classic straight track used for intercity trains. Crane rails deliver major goods in ports. Rails are essential for drilling and mining equipment as well as tunneling and for every manufacturing activity. The drivers of rail growth in the MENA region are the changes that affect all cities globally – ecology and economy.

Rail is growing everywhere as populations expand and automotive traffic becomes increasingly congested and a source of pollution. Other than oil, the region is also rich in minerals and mining and rail is necessary for the future of tunneling and excavation.

How has the rail sector evolved in the MENA region over the past 10 years? What are the drivers of this evolution?

Perhaps this last decade has been the birth of GCC and MENA railway as the cities began real urban planning and development. We first looked at the region about six years ago and started working on projects from our base in Milan. The growth and opportunity are such that we took the decision to establish our first ever international branch office here two years ago.

The drivers behind this regional growth are generally a strong central planning authority with the ability to anticipate the future. Young population, a growing awareness of the value of mass transport, the growing need to reduce the regional use of carbon-based resources and its carbon footprint. Then there is the rapid growth of investment trade which goes by sea. This sector, according to most authorities, represents nearly 90% of international shipping which therefore requires ports, cranes, lifting etc, all of which requires rail and often tunneling.

According to your view of the MENA market, what is the total value of rail projects today, and how do you see the size of the overall market growing over the next three to five years?

Every day sees new project announcements especially from the physically larger countries like Saudi Arabia. Our current estimation of announced rail and mining-based projects today is somewhere in the range of EUR 180 billion. As most of these projects have a span from announcement to completion of approximately three to five years – it is hard to accurately project the future. But it is a trend that is not just a trend – rail and tunneling are a part of the GCC and MENA future.

Valente claims to be one of the leading global rail equipment manufacturers. How do you compare – by revenues – among the top five such companies? How many of these competitors are also present in the MENA region?

Let’s begin by refining that definition of who we are, as this is a complex question. We do specific kinds of manufacturing in our factories but do not claim to be a leading rail manufacturer. However, to the best of my knowledge, we are probably the only one with our product range. In a certain way, we are best described as leading global rail merchants acting as both wholesaler and retailer. Particularly for all types of crane rails.

Manufacturing rail is fairly straightforward. The specialty we have is to do efficient design tailored to each specific project. In this, our capability in machining, fitting, and assembly is as important as the initial manufacture of the rail.

We can easily claim to be one of the global leaders in rail, tunneling and mining in terms of matching our vast experience of global projects as technical specialists that enter the project from design to construction to post-construction support. Because of our specialization in specific types of critical rail supply, we are the essential supplier of mandatory equipment for certain types of projects. Our technical and engineering services set us apart from many others.

In terms of revenues compared to the top global groups, there are three companies in our field for tunneling – two German groups and ourselves. In tunneling we are generally rated as number one in terms of quality and cost. If you split rail from the tunneling business, there are five groups that can do this kind of supply. In terms of rail, we are probably No. 2 in crane rails and probably one of the top three worldwide as rail merchants and rail system designers.

As far establishing a permanent presence in the GCC / MENA region, we are the first ones to have both rail and manufacturing to open a base here.

What percentage of profits is channeled into research and development? Does Valente own any patents in the rail equipment sector?

We are all about research, development and engineering excellence. We can say that about 5%-7% of our operating revenues are dedicated to keeping our leading edge in design development and technical support.

It is interesting that you ask about patents, and we in fact have several that are registered in our names. They are:

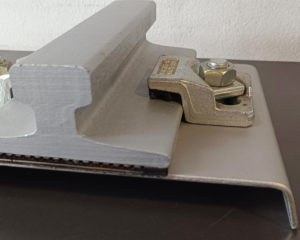

1. Monorail switch: Patented in 2004

2. Dolly system (for rapid undercarriage repair): Patented in 2008

3. Self-adjusting California crossing system: Patented in 2001

© Zawya 2012